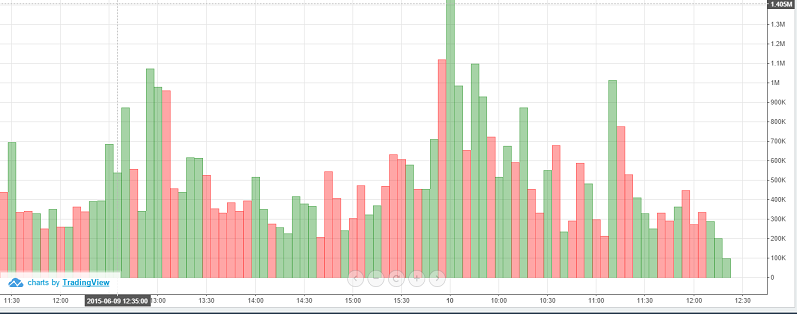

You’ll read a good deal in regards to the features of trading currencies – yet most traders usually turn advantages into disadvantages – as a result of lack of knowledge. This is why 95% of currency traders lose money – then there is one thing particularly that wipes out more trader equity than other things – volatility! Most forex traders simply can’t take care of volatility.

![]() Recommended Cryptocurrency Trading Software – With Bitcoin Evolution you can automate all of your trades or carry out manual trading by yourself through the smart program with your broker. The Bitcoin Evolution’s type of software has the capability to precede the markets by a notable amount of time, as much as 0.01 seconds, which can bring you huge profits!

Recommended Cryptocurrency Trading Software – With Bitcoin Evolution you can automate all of your trades or carry out manual trading by yourself through the smart program with your broker. The Bitcoin Evolution’s type of software has the capability to precede the markets by a notable amount of time, as much as 0.01 seconds, which can bring you huge profits!

Currencies are volatile, plus theory you are able to trade for thousands in profits each day, but the the fact is:

Most traders make fundamental errors an internet to cope with volatility – and that is why they loose money. The primary error they’ve created has been stop placement. These traders are so keen in order to avoid risk, that they can actually create it. Money by placing their stops incorrectly – this provides you with themselves no chance of winning.

Volatility is additionally much more of a challenge to cope with if you use leverage. Many forex brokers will grant up to 400:1 leverage – if you can not take care of volatility, then leverage simply compounds the situation.

Many forex traders are fantastic at picking market direction, these traders are continually stopped out by volatility. They’re frustrated when they get stopped out – and after that see the trade internet browser make $10,000 to $30,000 – and they are not in!

Today, in your arena of instant communications, currencies tend to be volatile than ever before. As you are able to see the large, long-term trends on any forex chart, the volatility within these trends is large. This volatility will soon bring your equity – without having a currency trading process to combat it – and lead you to forex trading success.

If you want to achieve foreign currency trading, then you need to deal with volatility, so here are a couple of ideas to help you:

1. Do you know what standard deviation is?

If you do not, then look it to the internet at this time – or read our previous articles. In order to deal with volatility, then a knowledge of ordinary deviation is a necessity.

2. You have to take calculated risks

Most traders get their stops too close, even though they appear to experience a lower risk, in fact the possibilities are heavily in favour of their stop being hit. It may look a minimal risk in writing – but it is almost a guaranteed decrease of practice – which makes it high-risk.

An ideal example is the forex day trader – who thinks they’re able to place stops using daily support and resistance – and make risk low. However, all volatility is random in a nutshell routines – in order that they bid farewell to their equity.

If you need to win at trading, you will want to get as being a successful gambler – bet big once the likelihood is inside your favour – and bet, if they’re not.

Only place stops behind valid resistance and support – and become very selective along with your trading signals.

3. Accept draw-down in open equity

When trailing an end, be patient – you should ensure that is stays back far enough, to not be used out by market noise. That is hard if you see thousands in equity destroyed everyday. However, maintain forex trading system firmly devoted to the larger prize – and accept that you’ll have to take losses temporarily – to produce longer term meaningful gains.

Volatility in currency trading is a big advantage – however, you must learn how to deal with it correctly, to have currency-trading success. The general rule is that forex traders who wants deal with volatility and risk, will in long run lose their money.