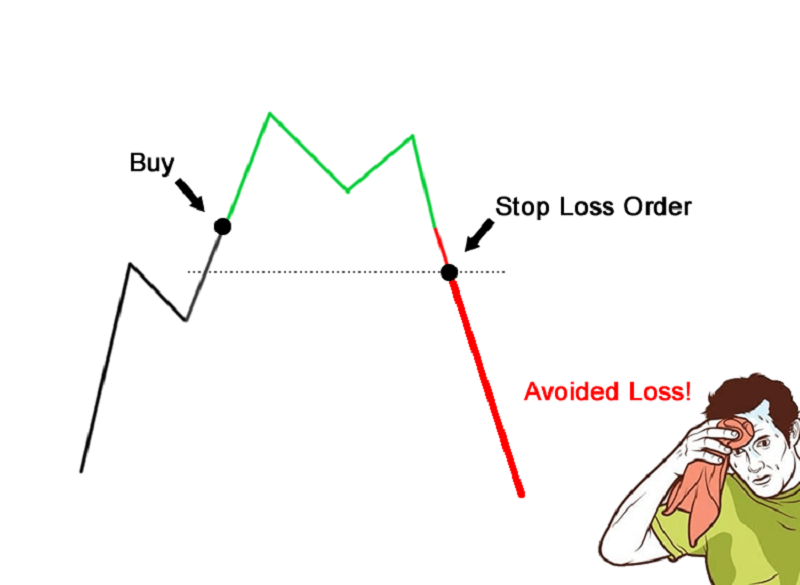

To protect you against unseen changes in forex market the most suitable option is using stop losses. There is a dearth of set rules with regards to placement of these stop losses & forex traders have to use under mentioned tips for making correct forex trading choices.

![]() Recommended Cryptocurrency Trading Software – With Bitcoin Evolution you can automate all of your trades or carry out manual trading by yourself through the smart program with your broker. The Bitcoin Evolution’s type of software has the capability to precede the markets by a notable amount of time, as much as 0.01 seconds, which can bring you huge profits!

Recommended Cryptocurrency Trading Software – With Bitcoin Evolution you can automate all of your trades or carry out manual trading by yourself through the smart program with your broker. The Bitcoin Evolution’s type of software has the capability to precede the markets by a notable amount of time, as much as 0.01 seconds, which can bring you huge profits!

Best Tips about Stop Losses

1. In each of the trades don’t put the same stop loss until and unless market conditions have been rightly checked.

2. Do not keep stop losses that go close to current prices to avoid negative outcomes on the trading account.

3. Ensure that every stop loss stays near the point you started trading from.

4. Do not hesitate on placing a stop loss if you see that such an action would increase your profits & the profit objectives are very clearly defined.

5. It is advisable to risk up to profit levels that are set and additionally use trades in which potential for profits is around 2 points for one forex pip as likely loss.

6. Occasionally it can occur that trader is not able to utilize the trading system in case equity risk is less that 5-7%. In this condition as an alternative trader has to confer with any expert to get to a solution.

7. It is also important not to believe in myths which state that its simple task earning millions with small investment of few hundred dollars without utilizing stop losses. Believing in such things is completely wrong & need to be avoided.

8. You are better off losing trades in which the loss amount equal few hundred points in comparison to trades in which loss amount can stack up to some thousand forex pips.

Steps to Choose Stop Losses?

The following section will elaborate on techniques using which stop loss points are easily defined.

1. Short along with long trades use 10 forex pips under/above 1st SAR dot which is parabolic appearing under/above the price candles.

2. These stop loss points can go up to 10 pips over the SAR spot in case short trades are used.

3. In case it is realized that stop loss obtained through SAR is far from the entry point then it means the trader is late & not entering market is more preferable.

4. Utilize 10 forex pips under/above from two day old high/low point & in case the market moves far ahead then make use of previous dayӳ high/low as stop loss point.

5. Make use of two 2 kinds of moving averages; 55EMA & 144MA. Set up stop loss at about 10 forex pips under/above any of the two MAs relying on the way account was set.

6. If there are short and also long trades then placing stop losses at 10 pips below/above Bollinger Bandӳ upper/lower part is more advisable.

A Final Note

As conclusion we will mention that stop losses are very helpful in protecting investors from variations taking place in market & with the help of above mentioned tips it will be easier for you to safeguard your investment.